GST Login – Step-by-Step Guide to Access Your GST Portal

Managing GST can feel overwhelming, but with the GST Login portal, businesses can easily file returns, track invoices, and stay tax-compliant.

🔹 Need to file your GST return?

🔹 Want to track input tax credits?

🔹 Facing login issues?

This guide will walk you through the GST login process, troubleshooting common errors, and securing your account.

What is GST Login?

The GST Portal Login allows businesses, taxpayers, and professionals to:

✔ File GST Returns (GSTR-1, GSTR-3B, etc.)

✔ Track tax liabilities & payments

✔ Generate & validate e-invoices

✔ Apply for GST refunds & cancellations

✔ View notices & compliance history

Every registered taxpayer receives GST credentials to access their dashboard via www.gst.gov.in.

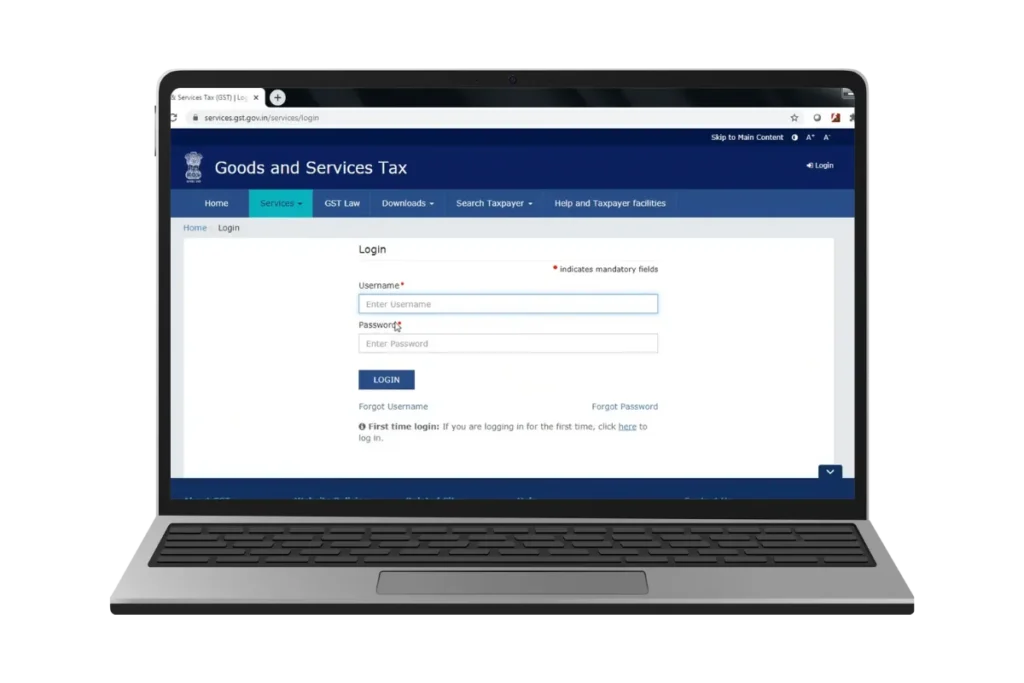

How to Log in to the GST Portal?

Step 1: Visit the Official GST Website

Step 2: Enter Your Credentials

Step 3: Verify Your Account (If Required)

Step 4: Access Your GST Dashboard

Once logged in, access GST returns, payments, invoices, and notices.

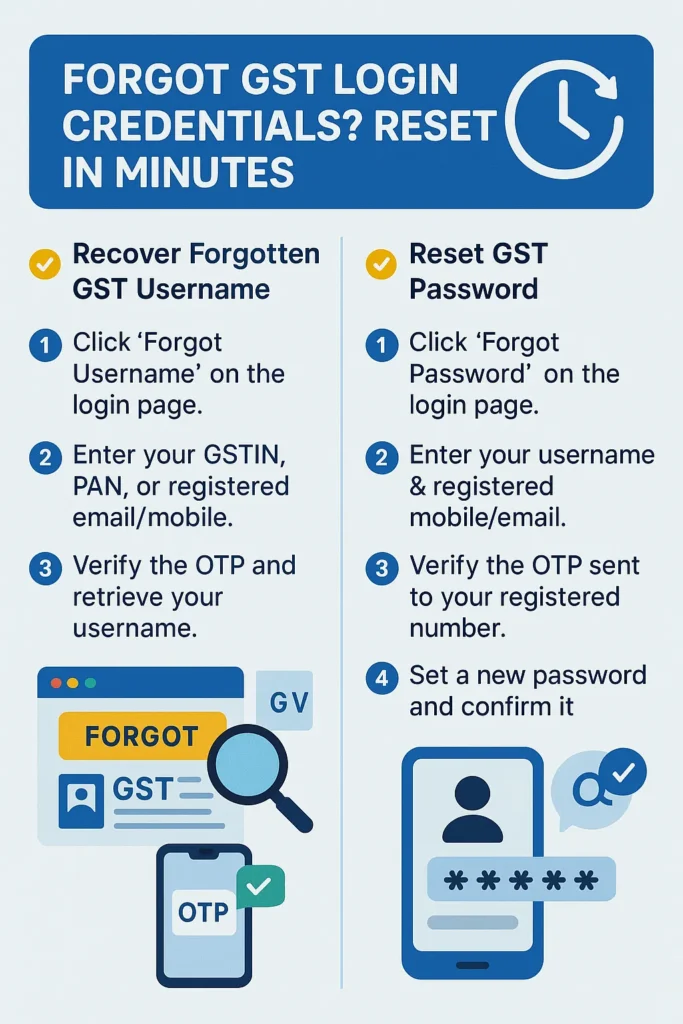

Forgot GST Login Credentials? Reset in Minutes

Recover Forgotten GST Username

1️⃣ Click ‘Forgot Username’ on the login page.

2️⃣ Enter your GSTIN, PAN, or registered email/mobile.

3️⃣ Verify the OTP and retrieve your username.

Reset GST Password

1️⃣ Click ‘Forgot Password’ on the login page.

2️⃣ Enter your username & registered mobile/email.

3️⃣ Verify the OTP sent to your registered number.

4️⃣ Set a new password and confirm it.

Unlock a Blocked GST Account

If multiple failed login attempts block your account, wait 24 hours or reset your password.

Common GST Login Issues & Fixes

GST Portal Not Opening?

✔ Clear cache & cookies and try again.

✔ Use an updated browser (Chrome, Edge, Firefox).

Incorrect GST Login Credentials?

✔ Check Caps Lock while entering credentials.

✔ Reset password if needed.

OTP Not Received?

✔ Wait for 5-10 minutes and check spam/junk folders.

✔ Update your registered mobile/email if necessary.

Account Locked?

✔ Reset your password or contact GST support at 1800-103-4786.

Key Features of GST Portal After Login

✔ File GST Returns: Submit GSTR-1, GSTR-3B, GSTR-9, etc.

✔ Check Input Tax Credit (ITC): View ITC claims & mismatches.

✔ Track GST Payments: Download challans & payment receipts.

✔ E-Invoice Generation: Generate IRN & e-Way Bills.

✔ View Notices & Compliance Status: Respond to GST department queries.

GST Login FAQs

Conclusion

The GST Login Portal is the gateway to seamless tax filing, payments, and compliance. Whether you’re a business owner, tax consultant, or CA, logging in regularly ensures error-free filings & compliance tracking.